By Bill Harvey for FOX

This is an excerpt from a 2019 exclusive study – Better to Best: How Live & Streaming TV Maximize ROAS: Update of Interruption Disruption – by FOX, working with Bill Harvey Consulting to reinforce and validate the earlier conclusions in the 2017 study, Interruption Disruption, also by FOX with Bill Harvey Consulting. The goal was to drill down on the sales effects (Return On Investment, Return On Ad Spend, Sales Lift) of advertising in two of TV/streaming’s fastest growing, highest profile advertising environments, sports programming (especially NFL) and branded integrations.

The excerpt below focuses on live and streaming TV sports programming.

KEY FINDINGS: TELEVISED SPORTS IMPACT

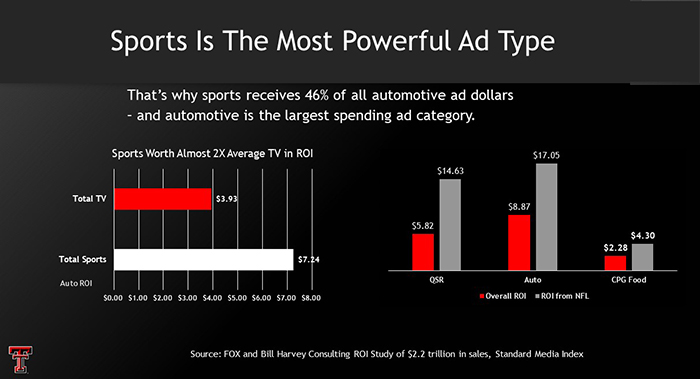

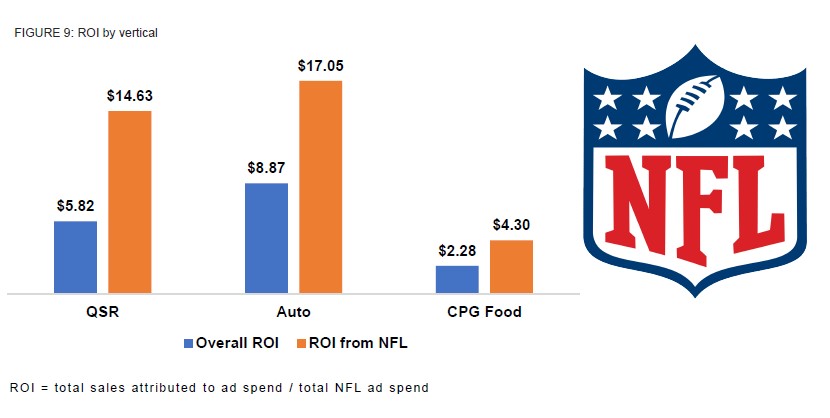

Sports had the highest ROI on average, over entertainment and news, for automotive and Quick Service Restaurants (QSR). The NFL, in particular was an exceptional performer, delivering ROI nearly 3x higher than average on QSR and approximately 2x higher on Automotive and CPG food.

Television’s sight-sound-motion based attention benefits are heightened in sports’ real-time, communal experience. Viewers’ investment in teams, players and the unfolding of outcomes amplifies excitement, immediacy, and a sense of modern heroics in a manner unparalleled in other program types.

The strong sales effects shown below (figures 2, 3, 4, 5, 6) for sports are reflective of the impact the passionate viewer experience has on the advertising contained within it and are in line with our prior findings on the NFL.

Figure 2

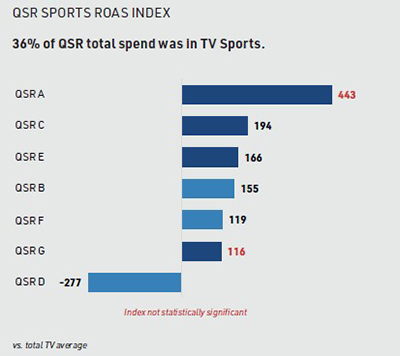

QSR in Sports

QSRs are significant spenders in sports and in our analysis, in six of the seven QSR cases, TV sports spend evidenced positive correlation with increased ROAS. In the 7th case, QSR brand D, Sports was correlated with negative ROAS. It should be noted that QSR brand D spent as much on sports as the biggest advertiser in the vertical—three times its size in terms of market share—hence may have overspent; but also that QSR brand D is the only brand in the vertical to gain market share over the 5.5 years of the study. In general, during the study period many new competitors entered the field across verticals resulting in widespread loss of market share, which makes the occasional appearance of cases of negative ROAS unavoidable. The data suggest that sales results would likely be worse for some (i.e., brand D) in the absence of advertising. In QSR for example, only one advertiser averaged lower sales numbers in 2019 than in 2014, but only one advertiser gained market share.

Even with one declining brand, the ROAS impact of sports to QSR brands was +131% above the total TV average for the vertical. In an environment of rapid acceleration of competitive pressure, advertisers across QSR and automotive found the significant reliance on sports to be an engine of continued growth.

Figure 3

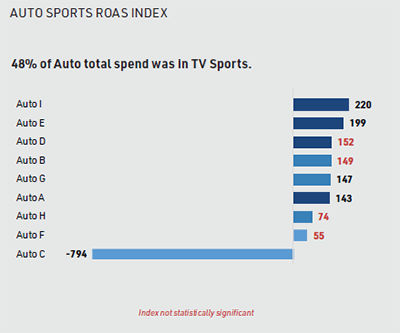

Auto in Sports

Most of the analyzed Auto brands (six of nine) showed higher ROAS for Sports compared to overall TV in the category, four at 95% confidence. Auto brand C, which shows negative ROAS, is by far the biggest auto brand in the study and may have reached a point of saturation, although its high absolute amount and concentration of spend may have contributed to its comparatively low rate of sales decline versus the industry. Overall, advertising in sports drove +121% higher ROAS for automotives than the average for total TV.

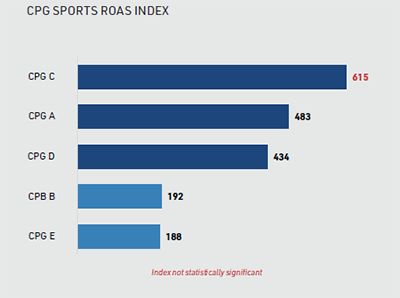

Figure 4

CPG in Sports

All five qualifying CPG advertisers show higher ROAS from Sports than from TV as a whole, with all but one at 95% confidence. CPG advertiser C, the only one below the statistical threshold, was also the lowest Sports spender in the vertical. Generally speaking, these large CPG advertisers target women and spend only 14% of their total outlay in Sports programming, but this analysis shows significant ROAS upside in increased sports expenditure.

Figure 5

Sports already commands the lion’s share of allocation in QSR and Automotive. And it continues to drive effectiveness and warrant maintaining or growing spend in most cases.

Figure 6